|

With some lenders moving towards collateral charge mortgages, it’s important to understand the differences between a collateral and a standard charge mortgage.

The primary difference is that a collateral charge mortgage registers the mortgage for more money than you require at closing. For instance, up to 125% of the value of the home at closing with some banks or 100% through many credit unions, instead of the amount you need to close your transaction (as is the case with a standard charge mortgage). The major downside to a collateral mortgage becomes evident at your mortgage renewal date. For borrowers who want to keep their options open at maturity and have negotiating power with their lender, this isn’t the best product feature because collateral charge mortgages are difficult to transfer from one lender to another. In other words, if you want to change lenders in order to seek a better product or rate in the future, you have to start from the beginning and pay new legal fees, which range from $500 to $1,000. With a standard charge mortgage, in most cases, the new lender will cover the charges under a “straight switch” in order to earn your business. In addition, with a collateral charge, it could be difficult to obtain a second mortgage or a home equity line of credit (HELOC) unless your home significantly appreciates in value. Lenders offering collateral charge mortgages promote the benefit that it makes it easier and more cost effective to tap into your equity for such things as debt consolidation, renovations or property investment. There’s no need to visit a lawyer and pay legal fees – the money is available as your mortgage is paid down. Yet, if you read the fine print, you may still have to re-qualify at renewal. A standard charge mortgage gives you the ability to move to another lender at renewal should you want to without incurring legal fees, and many borrowers find it more beneficial to keep their options open. If you need to borrow more with a standard charge mortgage, you have the option of a second mortgage or a HELOC, which also enables you to take money out as your mortgage is paid down. Navigating through the mortgage process alone can be tricky. Working with a mortgage professional who has access to multiple lenders will help ensure you receive the product and rate catered to your specific needs. Read about how a collateral mortgage can trap you Read about a real life story of the pitfalls of a collateral mortgage

0 Comments

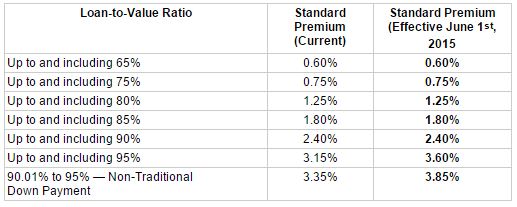

CMHC to Increase Mortgage Insurance Premiums OTTAWA, April 2, 2015 -- As a result of its annual review of its insurance products and capital requirements, CMHC is increasing its homeowner mortgage loan insurance premiums for homebuyers with less than a 10% down payment. Effective June 1, 2015, the mortgage loan insurance premiums for homebuyers with less than a 10% down payment will increase by approximately 15%. For the average Canadian homebuyer who has less than a 10% down payment, the higher premium will result in an increase of approximately $5 to their monthly mortgage payment. This is not expected to have a material impact on housing markets. http://www.cmhc-schl.gc.ca/en/corp/nero/nere/2015/2015-04-02-1605.cfm |

AuthorRita Cousins Archives

March 2020

Categories |

Rita Cousins - Mortgage Broker working with Mortgage Architects in Langley, Surrey, Maple Ridge, Abbotsford, White Rock, Nanaimo, Parksville, Qualicum, Duncan, and Ladysmith.

Lower Mainland & Vancouver Island

Lower Mainland & Vancouver Island

Copyright © 2014 - 2024

RSS Feed

RSS Feed